Insurance Price Hikes Leaving Mackay Residents at Risk

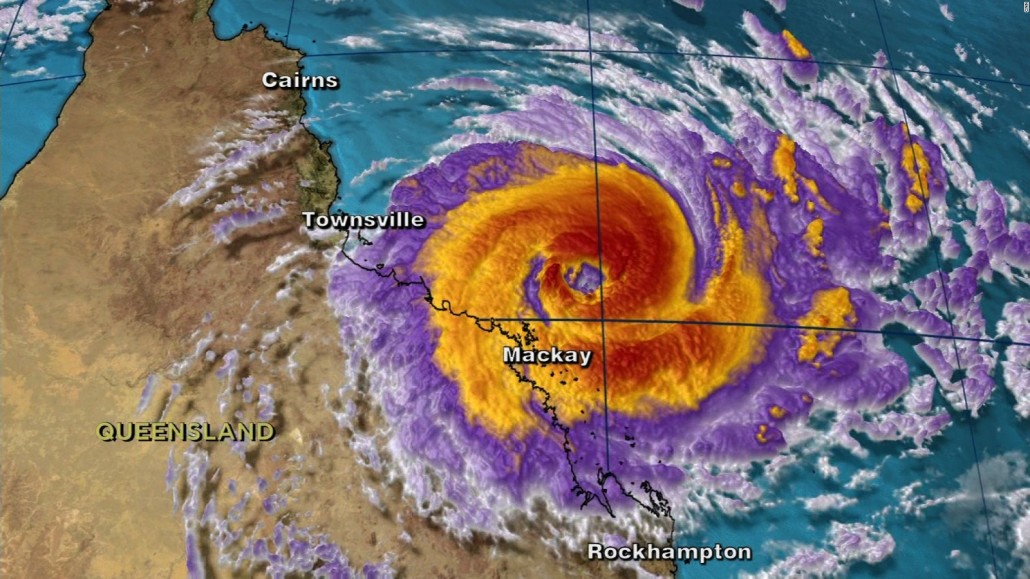

Homeowners in Northern Queensland have been left in a state of stress in the aftermath of Tropical Cyclone Debbie – which hit the coast of Queensland and NSW In March of last year and caused an estimated $1.85 billion of damage – as their insurers have now raised premiums by as much as 60 per cent and are refusing to insure a number of high-risk properties.

Areas of the Whitsundays and Mackay have been the worst affected, as the ACCC launches an inquiry into the affordability and availability of home, contents and strata insurance across most of the region.

“Many consumers in Mackay have expressed significant concern about the cost of insurance and the rate that insurance premiums have risen from year to year,” an ACCC spokesman said.

“The main concerns that the ACCC have heard throughout this inquiry relate to insurance premiums that have become or are becoming unaffordable, especially for lower income people…”

Last month, the Daily Mercury even reported on a mother of three from South Mackay who was left in a state of shock when her home and contents insurance bill increased to three times its usual cost, despite no claims having ever been made in the 40 years her parents had owned the property.

“We used to pay $180 a month. It’s now $480 a month. How can families afford to pay close to $100 a week on top of mortgages, private health and all your other expenses?” she asked.

“Even though we’ve never made a claim we get slogged with a ‘just in case a cyclone hits your home’ premium.

“I’m glad the ACCC is investigating this…”

When she queried the price increase with her insurance provider, they determined that because a claim had never been made, it’s more likely one will be made in the future and that natural disasters like Cyclone Debbie were a contributing factor to price hikes. A number of other providers wouldn’t provide cover for her area.

Greater Whitsunday Alliance CEO Garry Scanlan spoke up on the issue, expressing concern about the possible economic impact of residents being unable to obtain home and contents insurance that provides cyclone protection.

“Honestly, if something isn’t done about this you’re going to see most of Australia start to move below the Tropic of Capricorn because the northern region can’t get insured and therefore people can’t live there,” he said.

“It goes for the whole region and rest of the north. If you can’t keep families here imagine what impact that will have on regional economy, one that is still on the mend in Mackay and the Whitsundays.

“We are trying to shine a light on the issue as it’s vast here and affects everybody that’s carrying insurance.”

Further research into the issue has revealed that close to 70 per cent of homes and businesses in the area have reported substantial price increases, with hikes of more than 60 per cent being made to most policies.

This falls in line with similar price hikes that have taken place in the region as a result of other natural disasters. For instance, in the period from 2005-06 to 2012-13, premiums in North Queensland rose by 80 per cent in the aftermath of countless natural disasters, including Cyclone Larry, Mackay storms and Cyclone Yasi.

Many residents in North Queensland were already paying an average premium of $3030 for home and contents insurance, which was nearly three times the Queensland average of $1015. Thanks to higher storm risks in this part of Australia, Queensland, and especially north Queensland have the highest property insurance premiums in Australia, with NSW residents only paying an average of $963, while many of the other states spend $700 or less on their property insurance.

Rockhampton residents have faced similar issues in the past, with a number of the homes in the area being insured under value, as the prices are simply too high.

High storm risks and the substantial cost of providing adequate coverage for these areas have seen insurance providers take drastic steps to limit their losses when natural disasters strike. This issue is currently under investigation, but for the time being, resident’s best hopes are to work through an experienced home and contents insurance broker.

As industry professionals with close working relationships with a number of the area’s insurance providers, Sarina Insurance can work on your behalf to obtain the best possible insurance for the best available price.

If you’re having trouble obtaining coverage for your property and are at a loss for what to do, contact us today! We’ll take the time to hear your concerns, establish your needs and do our best to secure you the insurance you need.